THR is a mandatory benefit that must be provided to all employees in conjunction with the religious holiday observed by the employee (based on the employee’s religion). Based on Government Regulation No. 36 of 2021 on Wages and Minister of Employment Regulation No. 6 of 2016 on Religious Holiday Allowance for Employees in Companies, THR is an obligation that must be carried out by employers to employees. THR is implemented by paying attention to several things, among others:

- All employees who have worked continuously for one month or more are entitled to THR; and

- All employees (i.e., both definite and indefinite period employees) are entitled to THR.

- THR must be paid no later than 7 (seven) days before the religious holiday.

- All employers are now obliged to provide THR to employees who have worked continuously for one month or more.

The amount of THR to be paid is based on the employee’s service period as follows:

- An employee with a service period of 12 continuous months or more is entitled to THR in an amount equal to one month’s salary.

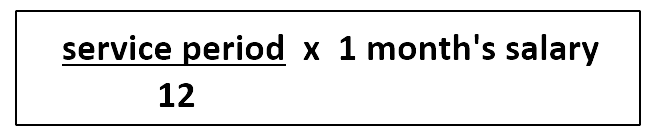

- An employee with a service period of one month or more but less than 12 months is entitled to a prorated amount of THR calculated using the following formula:

- For daily freelance workers, the one month’s salary is determined as follows:

- For those who have worked for 12 months continuously or more, the one month’s salary is calculated based on the average salary for the past 12 months.

- For those who have worked for less than 12 months, the one month’s salary is calculated based on the average salary received each month during employment.

Circular Letter 6/2021 stipulated that companies that are still affected by the Covid-19 pandemic and result in not being able to provide the THR in 2021 according to the specified time shall have a dialogue with their employees.

Minister of Employment, Ida Fauziyah, ask the Governor and Regent/Mayor to provide solutions by requiring employers to have a dialogue with their employees to reach an agreement implemented in a familial manner and in good faith. The agreement is made in writing and contains the time of payment of THR with the condition that it is paid at the latest until before the concerned Religious Holidays in 2021.

The agreement on the timing of THR payments must be ensured so as not to eliminate the obligation of employers to pay the THR in 2021 to their employees with the amount in accordance with the applicable law and regulations. The Government has asked the companies to prove the inability to pay the THR in 2021 according to the specified time, based on the company’s internal financial statements transparently. Companies that do deals with employees shall report the results of the agreement to the local government affairs that organizes employment.

Meanwhile, the Governor and Regent/Mayor shall enforce the law under their authority against violations of the provision of THR in 2021 by paying attention to the recommendations of the examination result of the employment supervisor. The Governor and Regent/Mayor are also asked to establish a Command Post for the Implementation of Religious Holiday Allowance 2021 (Posko THR) while paying attention to health protocols for preventing the transmission of Covid-19.

Employers who do not provide THR for their employees will be subject to the administrative sanctions under prevailing laws and regulations, which may be in the following forms:

- Written warning;

- Restriction of business activities;

- Temporary or permanent suspension of some or all production facilities;

- Suspension of business activities.

Apart from the THR, many more intricacies are involved in the employment laws which are not mentioned in this article. Should you need to have a legal consultation related to employment regulations in Indonesia, please do not hesitate to contact us or drop us an email at info@schinderlawfirm.com.